Published: June 2025

Disclaimer: This article is for general information purposes only. Sydney Bookkeeper is not a registered tax agent or financial advisor and this content does not constitute professional advice. Always consult with a qualified tax professional, registered tax agent, or qualified financial advisor before making investment decisions or implementing tax strategies.

Negative gearing remains one of Australia's most powerful yet misunderstood tax strategies for property investors and business owners. Despite ongoing political debates and market fluctuations, this investment approach continues to offer substantial tax advantages for those who understand how to leverage it effectively.

For Australian small and medium business owners, negative gearing presents unique opportunities to build wealth whilst reducing taxable income. However, the complexities surrounding this strategy often leave many entrepreneurs confused about whether it's right for their financial situation.

This comprehensive guide will demystify negative gearing, providing you with practical insights, real calculations, and strategic approaches tailored specifically for Australian business owners. Whether you're considering your first investment property or looking to optimise your existing portfolio, understanding negative gearing could significantly impact your financial future.

Negative gearing occurs when the costs of owning an investment property exceed the rental income it generates. This deficit can then be offset against your other taxable income, including business profits and salary, potentially reducing your overall tax liability.

The concept is fundamentally simple: if your investment property costs you more to maintain than it earns in rent, the Australian Taxation Office (ATO) allows you to claim this loss as a tax deduction. This deduction reduces your assessable income, which in turn reduces the amount of tax you pay.

The basic formula for negative gearing is:

Annual Property Expenses - Annual Rental Income = Tax-Deductible Loss

This loss is then applied against your total taxable income, reducing your tax obligation based on your marginal tax rate.

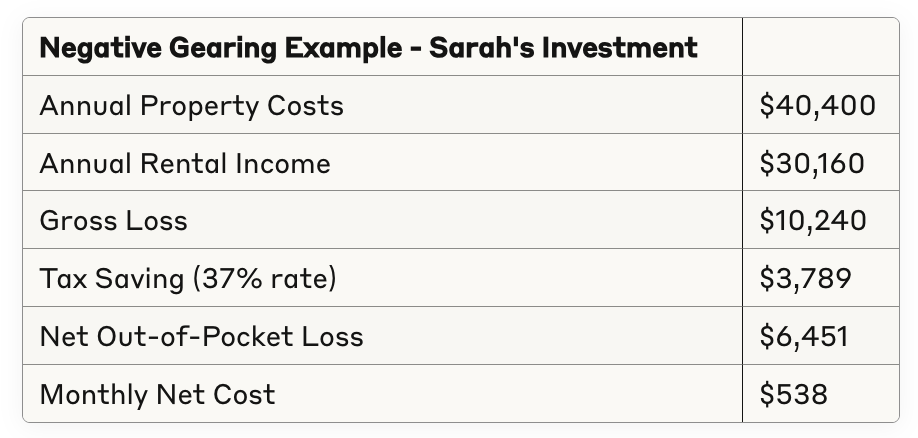

To understand negative gearing's practical application, consider Sarah, a successful marketing consultant with an annual income of $120,000. She purchases an investment property for $600,000 with a 20% deposit, financing the remaining $480,000.

$40,400 (costs) - $30,160 (income) = $10,240 loss

This $10,240 loss reduces Sarah's taxable income from $120,000 to $109,760. At her marginal tax rate of 37%, this saves her approximately $3,789 in tax, making her actual out-of-pocket loss only $6,451 annually.

The ATO allows various expenses to be claimed as tax deductions for investment properties. Understanding which expenses qualify is crucial for maximising your negative gearing benefits.

Mortgage interest typically represents the largest deductible expense for investment properties. This includes:

Professional property management services and maintenance costs are fully deductible:

Various insurance premiums and legal expenses can be claimed:

Ongoing property-related taxes and rates are deductible:

Depreciation represents a significant tax advantage for property investors, allowing you to claim the declining value of both the building and its fixtures.

For buildings constructed after 15 September 1987, you can claim 2.5% of the construction cost annually for 40 years. For a $500,000 property with a $400,000 building value, this equals $10,000 annually.

Items like carpets, blinds, hot water systems, and appliances can be depreciated at varying rates:

Business owners face unique considerations when implementing negative gearing strategies, particularly regarding cash flow management and tax planning.

Unlike salary earners who receive regular PAYG tax refunds, business owners must carefully manage the cash flow implications of negative gearing. The tax benefits may not be realised until the following financial year, requiring sufficient cash reserves to cover monthly shortfalls.

Business income can vary significantly year to year. A profitable year may maximise negative gearing benefits, whilst a lower-income year might reduce the strategy's effectiveness. Consider implementing income smoothing strategies to optimise tax benefits consistently.

Banks assess business owners' loan serviceability differently than employees. Ensure your business cash flow can comfortably service investment property loans, even during lean periods.

Negative gearing's ultimate success often depends on capital growth offsetting annual losses. When selling a negatively geared property, capital gains tax applies to any profit, though various concessions may reduce this liability.

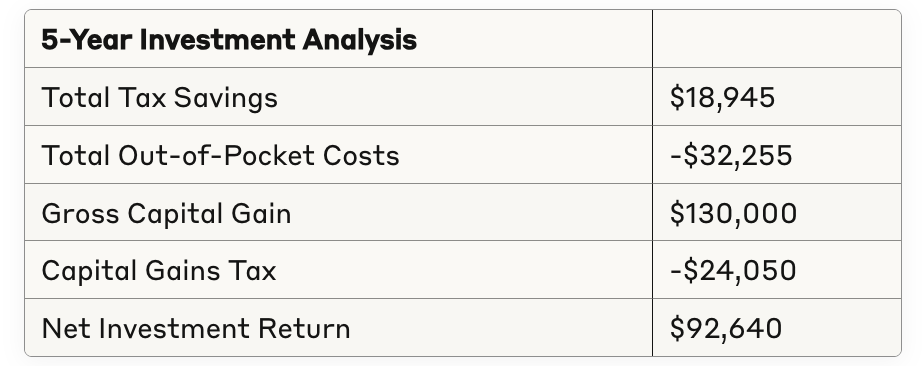

If Sarah sells her property after five years for $750,000, her capital gain calculation would be:

As an Australian tax resident holding the property for more than 12 months, Sarah qualifies for the 50% capital gains tax discount, reducing her taxable capital gain to $65,000.

Over five years, Sarah's total investment outcome includes:

This represents a total return of $92,640 after accounting for all costs and tax implications.

The effectiveness of negative gearing strategies can vary significantly based on market conditions and interest rate environments.

Rising interest rates increase borrowing costs, potentially increasing negative gearing losses but also tax benefits. Conversely, falling rates reduce losses but may indicate broader economic challenges affecting property values.

Understanding property market cycles helps optimise negative gearing timing:

Successful negative gearing requires comprehensive risk management to protect against various potential challenges.

Consider fixed-rate loans or interest rate hedging products to manage borrowing cost volatility. Split loans between fixed and variable rates to balance security and flexibility.

Minimise vacancy periods through:

Budget for unexpected maintenance costs by setting aside 1-2% of property value annually. Consider landlord insurance to protect against tenant damage and rental default.

While negative gearing offers significant advantages, alternative strategies may better suit certain situations.

Positive gearing occurs when rental income exceeds property expenses, generating immediate cash flow. While you pay tax on this income, you avoid ongoing out-of-pocket expenses.

Neutral gearing aims to balance rental income with expenses, minimising both tax benefits and out-of-pocket costs. This approach suits investors prioritising cash flow stability over tax advantages.

SMSFs can purchase investment property using different tax rules. With a 15% tax rate during accumulation phase and potential tax-free status in pension phase, SMSF property investment may offer superior long-term returns.

Negative gearing faces ongoing political scrutiny, with various reform proposals potentially affecting its future viability.

Previous governments have attempted to restrict negative gearing to new properties only, though these proposals haven't been implemented. Stay informed about potential policy changes that could affect existing investments.

Most proposed reforms include grandfathering provisions protecting existing investments. However, future purchase decisions should consider potential policy changes.

Implementing negative gearing strategies requires professional guidance to ensure compliance and optimisation.

Engage a qualified tax agent familiar with property investment taxation. They can help structure investments optimally and ensure all eligible deductions are claimed.

Integrate negative gearing strategies with broader financial planning objectives. Consider how property investment affects retirement planning, estate planning, and overall wealth accumulation.

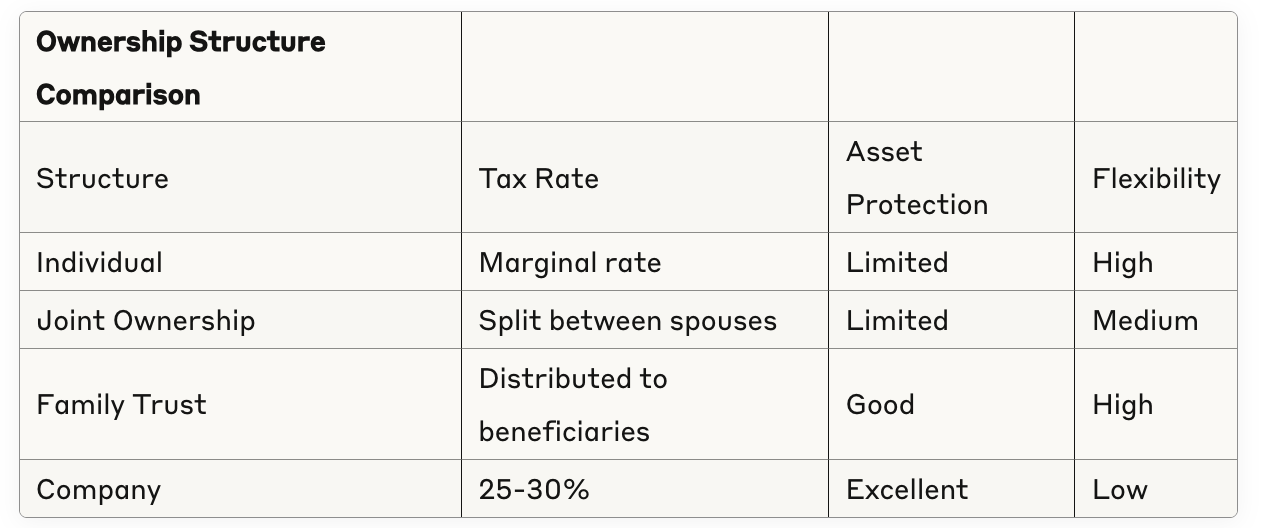

Consider various ownership structures:

Each structure offers different tax implications and asset protection benefits.

Modern technology simplifies negative gearing management and record-keeping requirements.

Digital platforms streamline rental management, expense tracking, and tax reporting. Many integrate with accounting software to automate deduction calculations.

Mobile apps enable real-time expense recording and photo documentation for tax purposes. This ensures no deductible expenses are overlooked.

Online depreciation calculators help estimate annual depreciation deductions, though professional quantity surveyor reports provide more accurate assessments.

Avoid these frequent errors that can reduce negative gearing effectiveness:

Maintain detailed records of all property-related expenses, including receipts, invoices, and bank statements. Poor record-keeping can result in missed deductions or ATO penalties.

Clearly separate investment property expenses from personal costs. The ATO requires expenses to be genuinely incurred for income-producing purposes.

Focusing solely on tax benefits whilst ignoring capital growth potential can result in poor long-term investment outcomes. Seek properties in areas with strong growth fundamentals.

Excessive borrowing can create unsustainable cash flow pressures, particularly during vacancy periods or interest rate rises. Maintain conservative debt levels relative to income.

Understanding potential future changes helps inform long-term investment strategies.

Australia's growing population and urbanisation trends support continued housing demand, potentially maintaining negative gearing's viability.

Interest rate cycles, inflation trends, and economic growth patterns will continue influencing negative gearing effectiveness.

While negative gearing faces periodic political challenges, its entrenchment in Australia's tax system and property market suggests likely continuation, albeit potentially with modifications.

Yes, negative gearing applies to all income-producing properties, including houses, units, townhouses, and commercial properties. The key requirement is that the property must be available for rent to generate assessable income.

Most lenders require a minimum 20% deposit for investment properties to avoid lenders mortgage insurance. However, some lenders accept 10% deposits with LMI, and guarantor loans may enable lower deposits.

Yes, negative gearing losses can be offset against all forms of assessable income, including business profits, salary, and other investment income, subject to non-commercial loss rules for high-income earners.

If rental income exceeds expenses, you'll pay tax on the profit. However, you can still claim all legitimate expenses as deductions, and capital gains benefits remain available upon sale.

Businesses can own investment property, but different tax rules apply. Corporate tax rates may be lower than individual marginal rates, but capital gains tax discounts aren't available to companies.

Hold periods depend on individual circumstances, but maintaining ownership for at least 12 months qualifies for the 50% capital gains tax discount. Many investors hold properties for 7-15 years to maximise capital growth benefits.

If cash flow becomes problematic, consider increasing rent (if below market), refinancing to reduce interest payments, or selling the property. Never maintain investments that create financial stress.

Yes, negative gearing is available for all investment properties, regardless of whether it's your first or subsequent purchase. However, ensure you understand the ongoing financial commitments involved.

Banks consider negatively geared properties when assessing loan applications, typically recognising 75% of rental income while counting 100% of expenses. This can reduce borrowing capacity for subsequent purchases.

Maintain all property-related receipts, loan statements, rental records, and depreciation schedules. The ATO recommends keeping records for five years after lodging your tax return.

Disclaimer: This article is for general information purposes only. Syd Bookkeeper is not a registered tax agent and this content does not constitute professional tax advice. Always consult with a qualified tax professional or registered tax agent before making investment decisions or implementing tax strategies.

sydney bookkeeper offers expert bookkeeping services sydney-wide for business owners, finance managers, and accounting firms to fuel local business growth.our sydney team delivers affordable packages, including professional bookkeeping, invoicing, payroll, and xero services.

from reconciliations to bas and xero setup, we ensure ato compliance, cut costs, and automate tasks, helping you scale confidently without long term contracts.perfect for businesses throughout sydney seeking reliable, local support.

ready to simplify bookkeeping and focus on growth?

our sydney bookkeeper experts will assess your needs and show how much time and money you can

save with our tailored services. no lock-in contracts.

pay only for what you use and pause anytime.